Have you ever felt like budgeting means saying goodbye to fun? Like every dollar has to go toward bills, savings, or other essentials, leaving no room for the things that make life enjoyable? Many people avoid budgeting because they think it’s restrictive, but in reality, a good budget gives you the freedom to enjoy life without financial stress.

Living on a budget doesn’t mean cutting out everything fun—it just means being intentional with your spending. You can still travel, dine out, and enjoy entertainment while managing your money wisely. Let’s explore how you can balance financial responsibility with a lifestyle you love.

Why Budgeting Matters

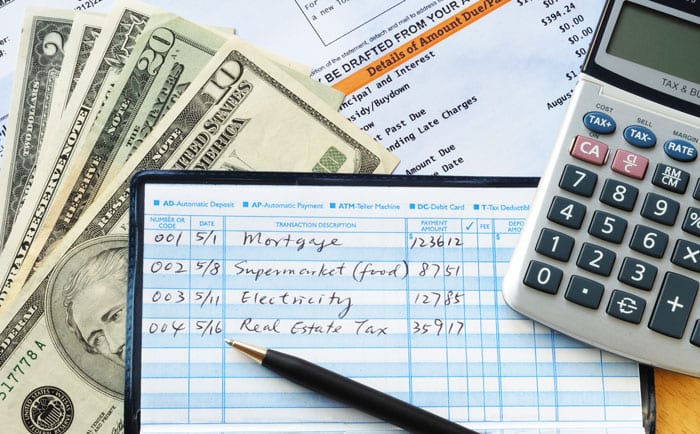

A budget is more than just a plan—it’s a tool that helps you take control of your money. Without a budget, it’s easy to overspend on small things without realizing where your money is going. Ever checked your bank account and wondered, Where did all my money go? That’s what happens when you spend without a plan.

The key to a successful budget is balance. If you cut out all entertainment and personal spending, you might stick to your budget for a while, but eventually, you’ll feel deprived and start overspending. The goal is to manage your money in a way that allows you to cover necessities, save for the future, and still have fun along the way.

The 50/30/20 Rule – A Simple Budgeting Plan

One of the best ways to budget while still allowing for fun is the 50/30/20 rule. This simple formula helps you divide your income into three categories:

- 50% for Needs – Rent, groceries, utilities, transportation, insurance, and minimum debt payments.

- 30% for Wants – Dining out, entertainment, travel, hobbies, shopping, and non-essential spending.

- 20% for Savings and Debt Repayment – Emergency fund, retirement contributions, and paying off extra debt.

This approach ensures that you’re being responsible with your finances while still leaving space for enjoyment. If you’re in a tough financial situation, you might need to adjust these percentages, but the important thing is to always dedicate something to fun—even if it’s small.

Finding Free and Affordable Fun

Having fun doesn’t have to mean spending a fortune. There are countless ways to enjoy yourself without breaking the bank:

- Free community events – Many cities offer free outdoor concerts, festivals, and movie nights. Check local event calendars to see what’s happening near you.

- Game nights or potlucks – Instead of going out to eat, invite friends over for a fun night in. A home-cooked meal and a good board game can be just as entertaining as an expensive night out.

- Discount days – Many museums, theaters, and amusement parks have discounted days or student/senior discounts. Take advantage of these deals whenever possible.

- Outdoor activities – Hiking, biking, swimming, and camping are all low-cost or free ways to enjoy time with family and friends.

Shifting your mindset about entertainment can make a huge difference. Fun isn’t about how much money you spend—it’s about the experiences you create.

Smart Spending on Entertainment

If you love going out, traveling, or dining at restaurants, you don’t have to give it up entirely. Instead, find ways to cut costs while still enjoying your favorite activities:

- Use coupons and discount apps – Websites like Groupon and Honey offer discounts on restaurants, events, and activities. Before making any purchase, check for available deals.

- Choose happy hours and lunch specials – Eating out doesn’t have to be expensive. Many restaurants offer happy hour deals or cheaper lunch menus that can help you save money.

- Limit subscription services – Do you really need five different streaming platforms? Cut down on unused subscriptions to free up extra cash for other fun activities.

- Plan vacations wisely – Travel can be affordable if you plan ahead. Look for flight deals, travel during off-peak seasons, and stay in budget-friendly accommodations like Airbnb or hostels.

By being mindful of your spending, you can still enjoy entertainment without hurting your finances.

Avoiding Lifestyle Inflation

One of the biggest budgeting mistakes people make is lifestyle inflation—spending more just because they earn more. It’s easy to fall into this trap. You get a raise, so you upgrade your apartment, buy a nicer car, and start dining at fancier restaurants. Before you know it, your expenses have grown just as fast as your income, leaving little room for savings.

Instead, when you get extra income, increase your savings and debt payments first. Then, decide how much to add to your fun budget. This way, you’re still enjoying your money while also securing your financial future.

Creating a “Fun Fund”

One of the best ways to ensure you can enjoy life while sticking to your budget is by setting up a “fun fund.” This is a separate savings account or budget category dedicated to entertainment and experiences. By setting aside a small amount of money each paycheck, you can enjoy guilt-free fun without worrying about overspending.

You can also try:

- The envelope system – Withdraw a set amount of cash for fun activities each month. Once it’s gone, you wait until the next month to spend again.

- Side hustles for fun money – If your current income doesn’t allow for much fun spending, consider picking up a side hustle like freelancing, pet-sitting, or selling items online. Use that extra cash exclusively for entertainment and travel.

Having a dedicated fun fund ensures that you can enjoy experiences without feeling guilty or dipping into your essential expenses.

Why This Matters to You

Living on a budget doesn’t mean living a boring life. It means being intentional with your money so you can enjoy life without financial stress. By planning your spending, cutting unnecessary costs, and finding creative ways to have fun, you can live a fulfilling life while still working toward financial stability.