How the Federal Reserve Controls Interest Rates and Why It Matters

The Federal Reserve (Fed) plays a crucial role in managing the U.S. economy by controlling interest rates. This power influences everything from inflation and employment to mortgage rates and stock market performance. But how exactly does the Fed control interest rates, and why does it matter to businesses and individuals?

What Is the Federal Reserve and Its Role in the Economy?

The Federal Reserve is the central banking system of the United States. Established in 1913, its primary objectives are to:

- Maintain price stability (control inflation)

- Promote maximum employment

- Ensure moderate long-term interest rates

To achieve these goals, the Fed adjusts monetary policy, mainly through interest rate control, which influences borrowing, spending, and investment across the economy.

How the Federal Reserve Controls Interest Rates

The Fed does not directly set all interest rates in the economy. Instead, it influences rates through several monetary policy tools.

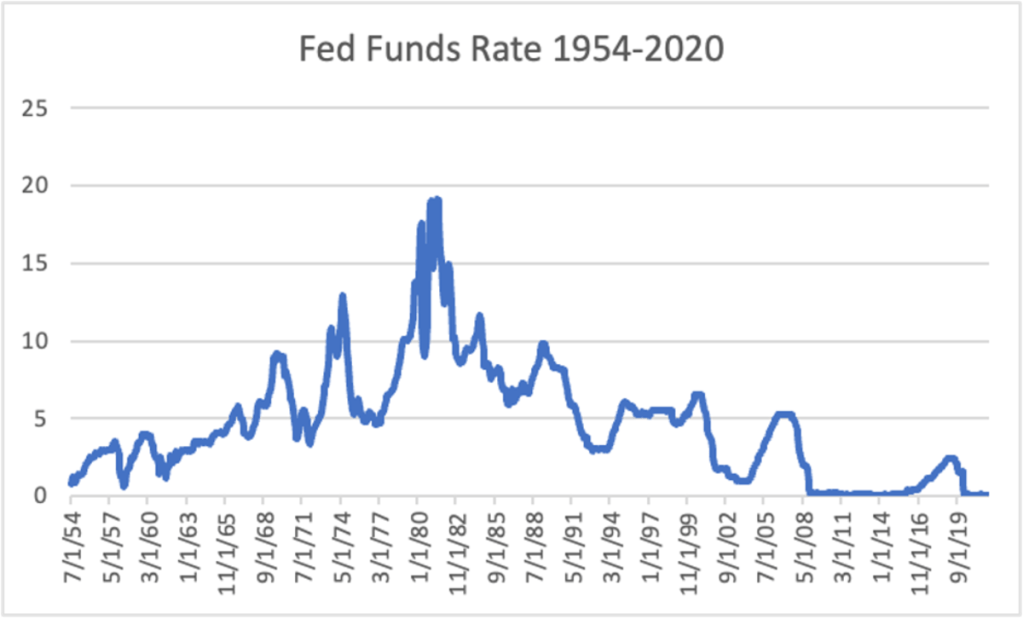

The Federal Funds Rate

The federal funds rate is the interest rate at which banks lend to each other overnight. The Fed sets a target range for this rate and influences it through monetary policy tools.

- When the Fed raises rates, borrowing becomes more expensive, slowing down economic activity and reducing inflation.

- When the Fed lowers rates, borrowing becomes cheaper, stimulating spending and investment.

Open Market Operations (OMO)

The Fed buys or sells U.S. Treasury securities to control the money supply.

- Buying securities injects money into the banking system, lowering interest rates.

- Selling securities removes money, increasing interest rates.

This process directly affects liquidity in financial markets and influences borrowing costs for businesses and consumers.

Interest on Reserve Balances (IORB)

Banks keep reserves at the Federal Reserve. The Fed pays interest on these reserves, which sets a benchmark for short-term interest rates.

- Higher reserve interest rates encourage banks to hold reserves instead of lending, reducing the money supply.

- Lower reserve interest rates incentivize banks to lend more, increasing the money supply.

The Discount Rate

The discount rate is the interest rate the Fed charges banks for borrowing directly from it.

- Raising the discount rate discourages banks from borrowing, tightening credit availability.

- Lowering the discount rate makes borrowing easier, stimulating economic growth.

This tool is used in emergencies to provide liquidity to banks but also serves as a signal of the Fed’s policy direction.

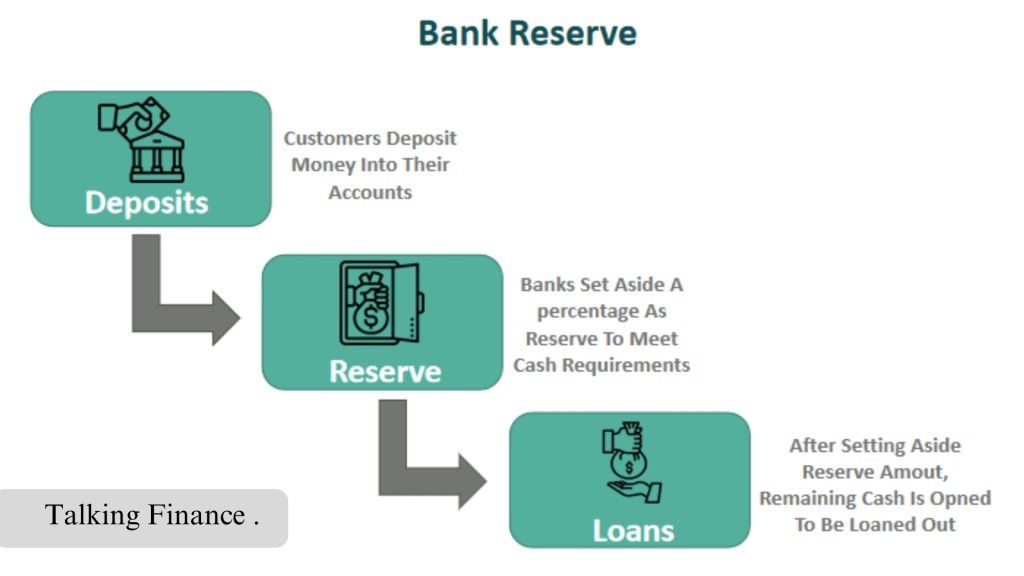

Reserve Requirements (Rarely Used Today)

In the past, the Fed required banks to hold a certain percentage of deposits as reserves. While this tool is less commonly used today, it historically helped control the money supply.

Why Interest Rates Matter for the Economy

The Fed’s control of interest rates has widespread effects on businesses, consumers, and investors.

Impact on Inflation

Inflation occurs when prices rise due to excessive demand or supply constraints.

- Higher interest rates slow inflation by making borrowing more expensive, reducing spending.

- Lower interest rates can fuel inflation by increasing spending and borrowing.

Effect on Employment and Wages

- Lower interest rates encourage businesses to expand, invest, and hire more workers, reducing unemployment.

- Higher interest rates slow down business expansion, potentially leading to layoffs or slower wage growth.

The Fed balances interest rates to promote job growth without causing excessive inflation.

Impact on Consumer Borrowing

Interest rates affect borrowing costs for everyday people, influencing:

- Mortgage rates: Higher rates make home loans more expensive, slowing down the housing market.

- Car loans and credit cards: Higher rates increase monthly payments, reducing consumer spending.

- Student loans: Federal student loan rates are tied to interest rate changes, affecting affordability.

Stock Market and Investment Effects

Investors watch the Fed closely because interest rates impact stock prices and market performance.

- Low interest rates: Companies borrow cheaply to expand, increasing earnings and boosting stock prices.

- High interest rates: Investment slows, reducing stock market gains.

Global Economic Impact

Since the U.S. dollar is a global reserve currency, Fed rate changes affect exchange rates, international trade, and investment worldwide.

- Higher rates strengthen the U.S. dollar, making exports more expensive for foreign buyers.

- Lower rates weaken the dollar, making U.S. exports more competitive.

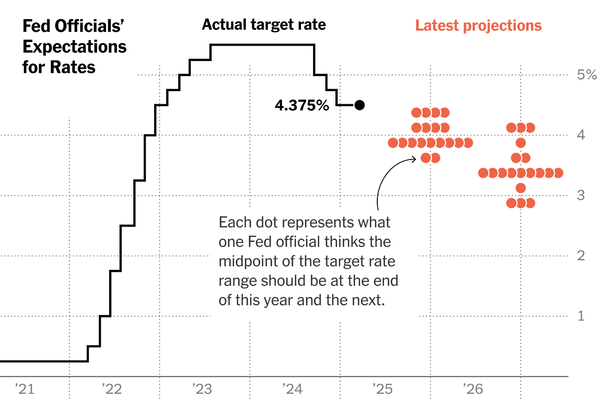

Recent Trends and Considerations

As of 2025, the Fed faces complex economic conditions, balancing:

- Inflation concerns after previous rate hikes.

- Slower economic growth due to higher borrowing costs.

- Geopolitical risks affecting global trade and supply chains.

Conclusion: Why the Fed’s Interest Rate Decisions Matter to You

Whether you are a borrower, investor, or business owner, Federal Reserve interest rate policies impact your financial future.

- If you’re looking to buy a home or take out a loan, Fed decisions influence how much you’ll pay in interest.

- If you’re an investor, interest rates can shape stock market trends and asset prices.

- If you’re a business owner, Fed policies affect borrowing costs, expansion plans, and overall economic conditions.

Understanding how the Fed controls interest rates helps you make smarter financial decisions in a constantly changing economic landscape.