Hedge funds are private investment vehicles that use a variety of strategies to generate high returns for their investors. Unlike mutual funds or exchange-traded funds (ETFs), hedge funds often take aggressive approaches, including short selling, leverage, and derivatives trading. They are typically available only to accredited investors due to their high risk and significant minimum investment requirements.

How Hedge Funds Work

Hedge funds pool money from investors and are managed by professionals who have the flexibility to invest in a wide range of asset classes, such as stocks, bonds, commodities, real estate, and even cryptocurrencies. Their goal is to deliver high returns, regardless of whether the market is going up or down.

Hedge funds differ from traditional investment funds because they are less regulated. This allows fund managers to use complex strategies that might not be permitted in mutual funds or ETFs.

(Image suggestion: A flowchart showing how hedge funds collect investor money and allocate it across different assets.)

Common Hedge Fund Strategies

Hedge funds use various strategies to maximize returns. Some of the most common include:

Long/Short Equity: Buying stocks expected to rise while short-selling stocks expected to fall.

Market Neutral: Balancing long and short positions to reduce market exposure.

Global Macro: Investing based on large-scale economic trends, such as currency movements and interest rates.

Event-Driven: Profiting from corporate events like mergers, bankruptcies, or restructurings.

Distressed Assets: Buying securities from struggling companies at a discount, hoping for recovery.

Each strategy has its own risk level and potential for returns. Some hedge funds specialize in just one approach, while others combine multiple strategies.

(Image suggestion: A table listing these strategies with brief descriptions.)

How Hedge Funds Make Money

Hedge funds operate under a “2 and 20” fee structure, meaning they charge:

- 2% management fee: A percentage of the total assets under management (AUM), paid annually.

- 20% performance fee: A percentage of the fund’s profits, incentivizing managers to deliver strong returns.

For example, if a hedge fund manages $1 billion and generates a 10% return ($100 million), the fund manager earns $20 million in performance fees, plus $20 million in management fees (2% of $1 billion).

While this structure rewards high performance, it has been criticized for being costly, especially if the fund underperforms.

(Image suggestion: A simple breakdown of the “2 and 20” fee structure in a graphic.)

Pros and Cons of Hedge Funds

Pros

- Potential for high returns

- Flexibility to invest in diverse assets

- Can generate profits in both rising and falling markets

Cons

- High fees compared to other investment options

- Often require large minimum investments

- Can be highly risky and volatile

(Image suggestion: A side-by-side comparison of hedge fund pros and cons.)

Should You Invest in a Hedge Fund?

Hedge funds are best suited for wealthy, risk-tolerant investors who can afford to lock up their money for extended periods. If you are considering investing in a hedge fund, make sure you understand the strategy, risks, and fee structure before committing.

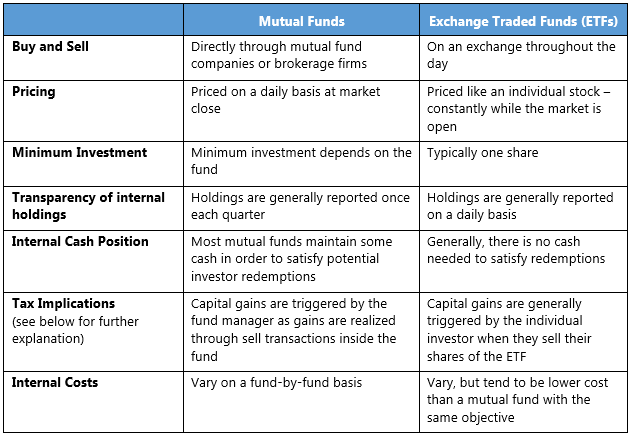

For most everyday investors, mutual funds or ETFs may offer a more accessible and cost-effective way to achieve diversified investment exposure.

(Image suggestion: A decision tree or flowchart helping readers determine if hedge funds are right for them.)

Conclusion

Hedge funds are complex investment vehicles designed to maximize returns through unique and often risky strategies. While they offer opportunities for high profits, they also come with steep fees and potential losses. Understanding how hedge funds operate can help investors determine whether they are a good fit for their financial goals.