When it comes to investing, the age-old debate between stocks and cryptocurrencies often arises. Both offer distinct opportunities and come with their own set of challenges. To help you decide where to allocate your funds, let’s first explore the world of stocks, backed by real examples, and then dive into the world of cryptocurrencies.

Stock Market Overview: Real Examples of Gains and Losses

Investing in stocks means owning a small piece of a company. The stock market has long been a trusted way for people to build wealth. While stocks can be volatile, they are generally considered a safer bet compared to cryptocurrencies due to regulation and market stability.

To understand how stocks perform, let’s look at two examples of stocks that have had significant movements over the past one year.

Stock Gaining in the Last 6 Months:

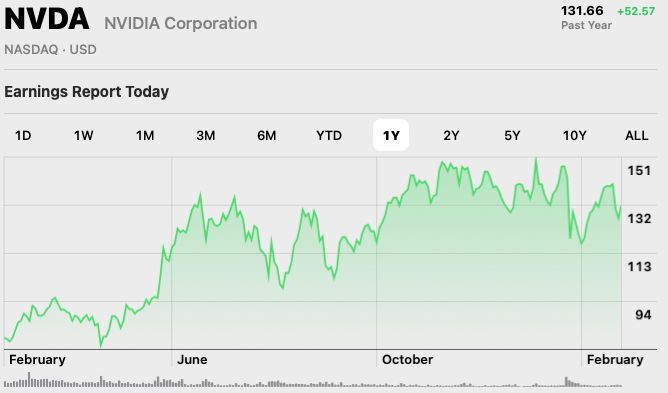

Nvidia Corporation (NVDA):

- Performance: Over the past year, Nvidia’s stock has increased from approximately $77 in February 2024 to $132in February 2025.

- Percentage Increase: This marks a gain of around 71.43% during this time.

Why Nvidia Went Up:

- Strong Earnings and Growth Potential: Nvidia has been a key player in the booming artificial intelligence (AI) sector. As demand for AI technology surges, Nvidia’s GPUs (graphics processing units) have become essential, leading to impressive revenue growth and surpassing market expectations.

- AI Boom: Nvidia’s role in the AI space has positioned it for strong future growth. With more companies relying on Nvidia’s hardware for AI training, their stock has benefitted from this increased demand.

- Positive Market Sentiment: Investor confidence in Nvidia is also a result of its consistent innovation and solid performance in gaming and AI markets.

Stock Declining in the Last Year :

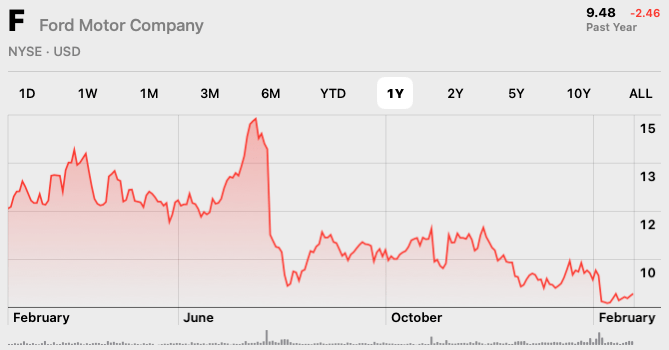

Ford Motor Company (F):

- Performance: Over the past year, Ford’s stock has dropped from around $12 in February 2024 to around $9 in February 2025.

- Percentage Decrease: This represents a decline of approximately -25% over this period.

Why Ford Went Down:

- Supply Chain Issues: Ford, like many other automakers, has faced ongoing issues with the global chip shortage, significantly hindering its production capacity.

- Rising Raw Material Costs: The cost of essential materials like steel and aluminum has increased, squeezing profit margins for companies like Ford.

- Competition in the EV Market: While Ford has made strides in the electric vehicle (EV) market, it is still playing catch-up to companies like Tesla and is struggling to capture significant market share.

The World of Cryptocurrencies

Now that we’ve explored stock performance, let’s dive into the world of cryptocurrencies. Cryptocurrencies like Bitcoin, Ethereum, and many others offer a decentralized alternative to traditional stocks, and while they come with higher risk, they also present the potential for massive rewards.

Key Characteristics of Cryptocurrencies:

- Decentralization: Unlike stocks, cryptocurrencies are not controlled by any central authority, which means they aren’t subject to government or institutional control.

- Volatility: Cryptocurrencies are known for their high volatility. Prices can fluctuate dramatically, offering opportunities for large gains—and equally large losses.

- 24/7 Market: The cryptocurrency market operates around the clock, unlike traditional stock markets that have set trading hours.

Crypto Performance: Recent Trends (1-Year Timeframe)

As of February 2025, let’s look at how Bitcoin (BTC) is performing compared to the SPDR S&P 500 ETF Trust (SPY), which tracks the overall stock market.

- Bitcoin (BTC): Over the last year, Bitcoin gone from about $54,000 in February 2024 to $83,019in February 2025, reflecting an increase of approximately 55.59%.

Bitcoin has risen about 55.59% from $54,000 in February 2024 to $83,019 in February 2025, highlighting the potential for gains in crypto. However, its volatility also means higher risk compared to traditional investments.

Comparing Stock and Crypto Performance Over the Past Six Months

Stocks: Nvidia (NVDA) and Ford (F) have shown very different trends. Nvidia has soared due to the rising demand for AI and GPUs, while Ford’s stock has struggled due to concerns over supply chain issues, rising raw material costs, and competition in the EV market.

Cryptocurrencies: Bitcoin (BTC), on the other hand, remains highly volatile. While it has experienced significant growth, it also faces unpredictable swings. Cryptocurrencies like Bitcoin can be riskier than stocks due to their volatility, with prices fluctuating based on market sentiment and external factors.

Making the Right Choice: Stocks or Cryptocurrencies?

Choosing between stocks and cryptocurrencies depends on your financial goals, risk tolerance, and investment strategy. Here’s how to decide:

- Risk Tolerance: Cryptocurrencies are riskier than stocks due to their extreme volatility. If you are uncomfortable with large fluctuations in value, stocks might be a better option for you. However, if you’re comfortable with high risk for the potential of higher rewards, cryptocurrencies could be worth considering.

- Investment Horizon: If you are looking for a stable, long-term investment, stocks might be more suited to your goals. Stocks have a proven track record of delivering consistent returns over time. Cryptocurrencies are more suited for those with a shorter-term investment outlook or those seeking to capitalize on volatile markets.

- Diversification: A balanced portfolio can include both stocks and cryptocurrencies. Having a mix of traditional and alternative investments helps mitigate risks and allows you to take advantage of different market conditions.

Conclusion

Both stocks and cryptocurrencies present unique investment opportunities with distinct advantages and risks. While stocks, like Nvidia, provide stability and potential for growth, cryptocurrencies offer the allure of rapid gains—albeit with greater risk. Whether you choose to invest in stocks, cryptocurrencies, or a combination of both depends on your financial goals, risk appetite, and investment strategy.