Have you ever scrolled through a financial news site, glanced at the rows of bond prices and yields, and wondered how on earth they’re determined in the first place? Have you ever been curious about why a bond’s price goes down when interest rates go up—or vice versa? Well, if so, you are in the right place. If not, bond pricing is one of the most fundamental aspects of fixed-income investing, and it’s important for you to know! Let’s dive into it.

What Are Bonds, Anyway?

At the most basic level, a bond is essentially a loan. When you buy a bond, you’re loaning money to a company (corporate bond) or a government (government or municipal bond) for a certain period. In return, the bond issuer promises to pay you interest at regular intervals (known as coupons) and to repay the original amount (the face value or par value) at maturity.

Bonds have three main characteristics to keep in mind:

Maturity Date: The specified date on which the issuer repays the face value of the bond.

Face Value (or Par Value): The amount the bond issuer promises to pay back at the end of the bond’s term. It’s typically stated as $1,000 for corporate bonds in the U.S., though it can vary.

Coupon Rate: The interest rate the bond pays based on the face value. For instance, if you buy a $1,000 bond with a 5% annual coupon rate, you’ll receive $50 per year in interest payments.

Why Do Bond Prices Fluctuate?

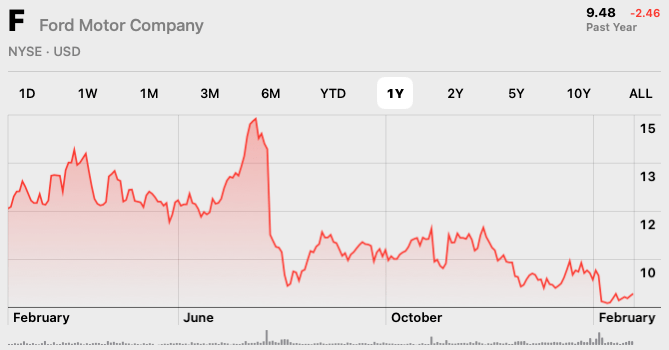

If you’ve ever watched the bond market during a financial segment, you may have seen bond prices changing throughout the day. One reason is supply and demand—the same phenomenon that influences stock prices. If many people want to buy a particular bond (i.e., high demand) while very few are selling it (i.e., low supply), the bond’s price can be driven up. Conversely, if there are more sellers than buyers for that bond, the price tends to go down.

However, supply and demand aren’t the only factors at play. The interest-rate environment also plays a huge role. Bond prices generally move inversely to interest rates. If interest rates in the broader market rise, newly issued bonds will come with higher coupon rates, making older bonds with lower coupon rates less attractive unless their prices drop. On the flip side, if interest rates fall, existing bonds with higher coupons become more attractive, and their prices go up.

To illustrate this, imagine you hold a bond that pays 5% annually. If interest rates in the market rise to 6%, the newly issued bonds will be more appealing to investors, meaning fewer folks will want your 5% bond. You might have to sell at a lower price (below the face value) to compensate a potential buyer for that lower coupon rate. In contrast, if the market rates fall to 4%, your 5% bond suddenly looks very enticing, and investors might pay more than the face value to get that higher coupon.

The Order Book for Bonds (Yes, They Have One Too!)

Much like stocks, bonds also have markets (though usually less centralized) where traders post buy and sell orders. However, the bond market is famously less transparent than the stock market and can be more decentralized. Still, the same logic applies: traders place bids (prices they’re willing to pay) and asks (prices they’re willing to sell at), and the bond actually changes hands when a buyer and seller agree on a price.

Because bond trades often happen over-the-counter (OTC) rather than on a big public exchange like the NYSE, you won’t always see a single order book on your screen. Instead, you might see indicative quotes from major dealers or electronic trading platforms. Nevertheless, the principle remains: bond prices are set by balancing what buyers are willing to pay and what sellers are willing to accept.

From Coupon Rate to Yield

It’s easy to confuse a bond’s coupon rate with its yield, but they aren’t the same thing. As mentioned earlier, the coupon is the fixed percentage of the bond’s face value you receive annually, whereas the yield is how much you actually earn on the amount of money you spent to buy the bond.

If you purchase a bond at face value (say, $1,000) and the coupon is 5%, you’ll receive $50 per year. Your yield would also be 5% because you’re earning $50 on $1,000. But, if you buy that same bond below face value—let’s say you only pay $900 for it—your yield rises. You’re still receiving $50 in annual coupon payments, but now on a $900 investment. This makes your annual yield higher than 5%. If you buy it above face value (perhaps $1,050), your yield will be lower than the stated coupon rate.

Yield to Maturity (YTM)

When analysts quote a bond yield, they’re often referring to something called Yield to Maturity (YTM). Yield to Maturity is a more comprehensive measure of return that takes into account:

- All coupon payments you’ll receive until maturity.

- Any capital gain or loss you’ll realize if you buy the bond at a discount or premium and then hold it until it matures at par value.

- The time value of money, meaning coupon payments in the near term are worth more than coupon payments far in the future.

The math for YTM can be a bit involved, often requiring either a financial calculator or a spreadsheet to compute. But here’s the main takeaway: YTM is the “true” annualized rate of return if you hold the bond until maturity and reinvest the coupon payments at the same rate.

Risk Factors and Credit Ratings

Bonds are often considered safer investments than stocks, but they aren’t risk-free. Two main risks you’ll see in the bond market are:

- Interest Rate Risk: The risk that interest rates will rise, causing bond prices to fall (if you need to sell before maturity).

- Credit Risk (Default Risk): The risk that the issuer won’t be able to make its scheduled interest payments or repay the principal at maturity.

To help gauge how likely a default might be, credit rating agencies like Standard & Poor’s, Moody’s, and Fitch assign credit ratings. High-quality bonds (AAA or AA) are less likely to default and usually pay lower yields. Lower-rated bonds (like BB or B, sometimes called “junk bonds”) pay higher yields to compensate investors for the higher risk of default.

The Yield Curve

One of the key visuals you’ll see when talking about bonds is the yield curve, which is a chart that shows yields on bonds of similar credit quality across different maturities. The U.S. Treasury yield curve is the most commonly referenced because Treasury securities are considered low-risk and help set a benchmark for other types of bonds.

Typical yield curves can be:

Flat: Yields are similar across maturities (often signals a period of transition in the market).

Normal: Longer-term bonds have higher yields than shorter-term bonds (often signals a healthy, growing economy).

Inverted: Short-term bond yields are higher than long-term bond yields (often signals economic uncertainty or a potential recession).

Bringing It All Together

So, let’s connect the dots: bond prices are influenced by factors like supply and demand, overall interest rates, and the issuer’s creditworthiness. Those prices, combined with the coupon payments, determine bond yields—the all-important measure of how much you actually earn as an investor.

If demand for a particular bond is high, its price will likely increase, lowering its yield.

If market interest rates rise, bond prices tend to fall to stay competitive.

If the issuer’s credit rating improves, its bond prices tend to rise and yields fall.

Why Does This Matter to You?

Whether you’re an aspiring investor eyeing fixed-income as part of a balanced portfolio or just someone wanting to understand the fundamentals of finance, learning the basics of bond pricing and yields can open the door to more advanced topics, like building an income ladder or hedging interest rate risk. Bonds can offer stable income and a counterbalance to the volatility in your stock holdings. By understanding how bonds are priced and how yields work, you’ll be better equipped to decide which bonds suit your investing goals and risk tolerance.

Now you know the basics of bond pricing and yields! You’ve just uncovered one of the pillars of fixed-income investing and taken a significant step in your journey to master the mechanics of money. Whether you choose to stick to safer government bonds or dabble in high-yield corporate bonds, always remember that understanding the interplay between price and yield will guide your decisions—and hopefully help you make more informed choices for your portfolio.

If you ever see those small numbers in red or green on a bond screen—remember, they’re more than just random flickers on a ticker. They are the reflection of market forces like interest rates, credit ratings, and investor sentiment dancing in real time. Happy investing!